How Do I Claim My Hsa On My Taxes

If you or anyone other than your employer deposited money into your HSA you should receive Form 5498 showing how much was deposited. Interest earned on your account is taxfree.

You are eligible for a tax deduction for additional contributions you made to your HSA even if you do not itemize your deductions.

How do i claim my hsa on my taxes. I only put around 100 in and have not deducted any since Ive gotten it. The only way to avoid this taxation is to file your own return and not be claimed as a dependent on your parents return. Do i have to claim my HSA contributions on my taxes.

When you make your own HSA contributions as opposed to using your employers salary reduction arrangement you make the contributions during the year with after-tax money and then you get to deduct your contributions on your tax return line 25 on Form 1040 regardless of whether you itemize deductions or take the standard deduction. You dont have to itemize to claim the HSA deduction. When an individual applies.

If contributions were made to your HSA based on you being an eligible individual for the entire year. IRS Form 8889 This form is specific to HSAs. Under Number 1 check Self-only or Family to indicate which type of HSA you hold.

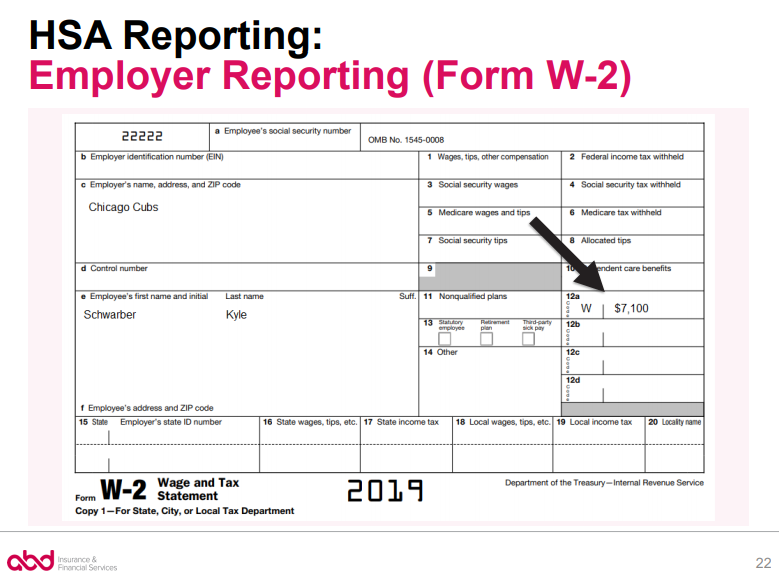

But that just eliminates the income tax theres no mechanism for recouping the payroll taxes. Tax-free account withdrawals - You can take the money out anytime tax-free to pay for qualified medical expenses. When youre getting ready to e-file your return any money deposited into your HSA by your employer will be listed in Box 12 of your Form W-2.

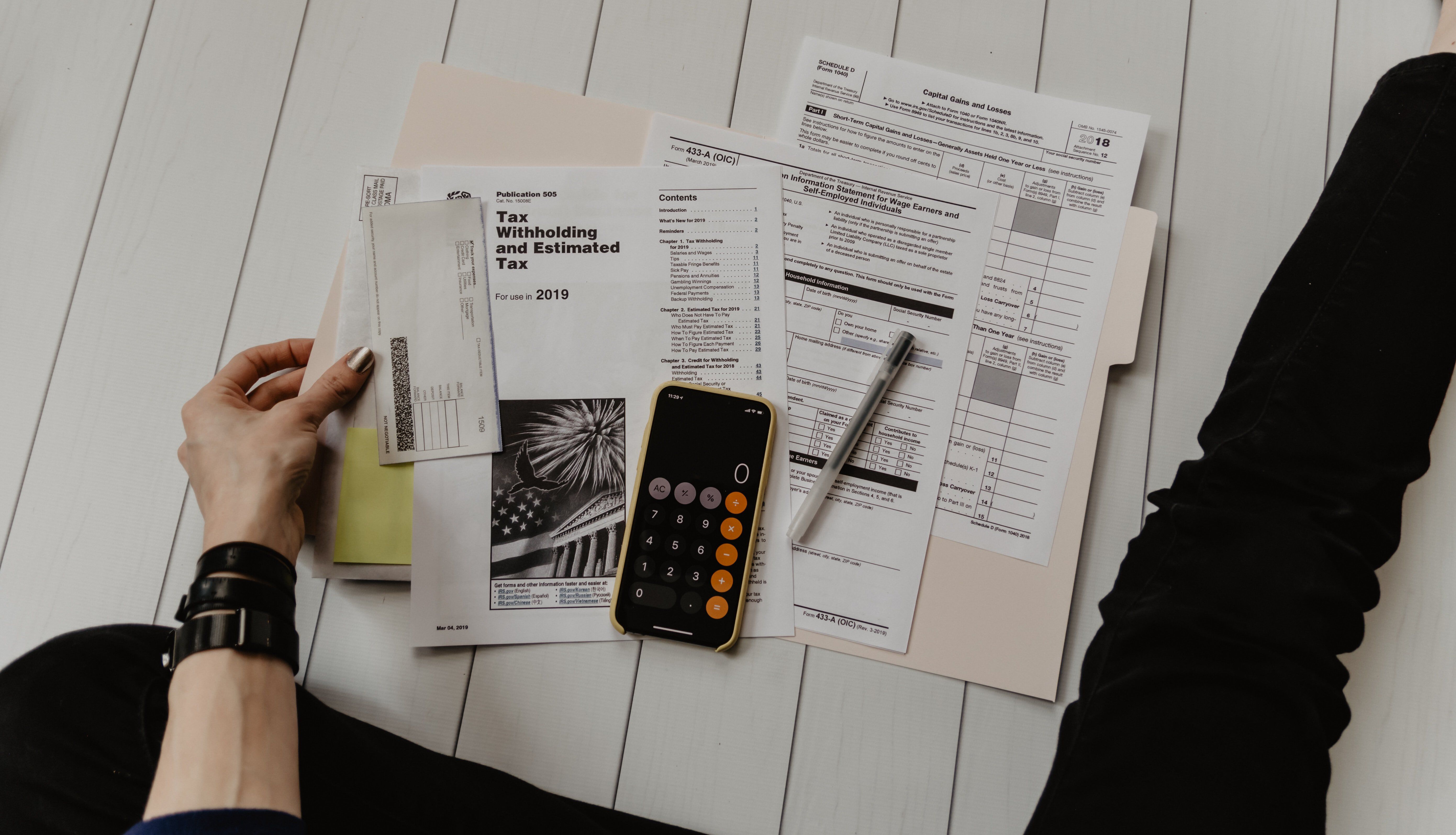

How to Claim the Federal Tax Deduction for an HSA Contribution Exploring the Basics of a Health Savings Account. Make sure to report your 2020 HSA contributions all non-medical HSA distributions and any excess HSA contributions on Page 2 if applicable. The trustee then shares that information to the account owner through IRS Form 1099-SA.

Assuming you make after-tax HSA contributions ie not through a payroll deduction since those are already pre-tax youll get to deduct them on your 1040 and avoid paying income taxes on the amount you contributed. In terms of reporting HSA tax information the HSA trustee or custodian keeps all reports of distributions. HSA account holders are responsible for reporting their own distributions to the IRS through Tax.

Its required if any HSA contributions have been made to your HSA from yourself another person or your employer you have withdrawn money from your HSA. Do I have to claim my HSA on taxes. If you are the beneficiary of a health savings account HSA then the IRS requires you to prepare Form 8889 with your tax return before you can deduct your contributions to the account.

If you are being required to upgrade and you dont want to then remove the trigger. Step 3 Use Part 1 to determine your HSA deduction excess contributions made by you and excess contributions made by your employer. See IRS Publication 969 external link PDF file.

Contributions you make to your HSA through payroll deductions may be excluded from your gross income. More on HSA deduction rules. This is one of the forms youll mail back to the IRS for your tax return.

Your own HSA contributions are taxdeductible or pretax if made by payroll deduction. Go back to the W-2 and remove the box 12 code W entry ONLY IF you are sure that you were qualified to make the contribution. The account is portable.

Since you are not eligible to contribute to the HSA any contributions that you made are considered to be excess contributions and will be taxed. Health savings accounts are commonly available to individuals who have. Figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual.

Figure your HSA deduction. IRS Form 1040 This is your individual income tax return. If you have a high-deductible health plan on your ownnot offered through an employeryou can sign up for an HSA right now.

Withdrawals for qualified medical expenses external link are taxfree. Before you can deduct your contributions to a health savings account HSA you must prepare IRS Form 8889. What HSA information do I need to report on my tax return.

Contributions made to your HSA by your. The balance grows tax-free - You can invest the money in your HSA and you wont owe taxes on your earnings. Open an individual account.

Report health savings account HSA contributions including those made on your behalf and employer contributions. Another perk of your HSA. Maximum allowable contribution for a self.

If you make HSA contributions directly you may be able to claim a tax deduction for that amount when you file your tax return. Under the last-month rule if you are an eligible individual on the first day of the last month of your tax year December 1 for most. Ready to file your tax return.

You can enroll in an HSA-qualified health plan and sign up for an HSA during your organizations annual open enrollment. Report distributions from HSAs.

Understanding Form 8889 For Hsa Contributions And Tax Deductions

You Can T Put A Price Tag On Love Amazingly Romantic Cruises Tax Write Offs Tax Deductions Filing Taxes

Hsa Tax Tips You Should Know Before You File This Year

Form 8889 Instructions Information On The Hsa Tax Form

Quickstudy Finance Laminated Reference Guide Tax Prep Checklist Business Tax Tax Prep

Hsa Tax Deduction Rules H R Block

How Your Hsa Can Lower Your Taxes

Why The Hsa Is The Best Investment Tool To Save For Retirement Good Money Sense Family Health Insurance Health Insurance Health Insurance Options

Health Savings Account Hsa Tax Filing Guide For The 2021 Tax Season

Hsa Form W 2 Reporting Abd Insurance And Financial Services

Form 8889 Instructions Information On The Hsa Tax Form

Publication 502 2013 Medical And Dental Expenses Medical Health Savings Account Irs Taxes

Tax Facts The Deductibility Of Hsa Contributions

A Guide To Reporting Hsa On Taxes Hsastore

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Post a Comment for "How Do I Claim My Hsa On My Taxes"