Cosigner For A Car Loan Liabilities

From the lien holders perspective it is more advantageous for the vehicle to have comprehensive and collision coverage if there is balance due on the loan. If youre a co-signer on a loan and youre looking to get approved for a mortgage you may be able to exclude that debt provided that you meet certain criteria.

Cosigner Responsibilities On An Auto Loan Auto Credit Express

Generally you are only responsible for the loan not what the primary borrower does with the car.

Cosigner for a car loan liabilities. Unless you also put your name on the title you have no other liability for what your sibling does with her car. Agreeing to pay off the loan if the primary borrower defaults. Also referred to as cosigner you guarantee the account and assume responsibility if the maker should default.

If you are on the. Joint contractual liability. Acquiring a first time car loan sometimes requires finding a cosigner who will guarantee payments.

However if you default on payments your cosigner will be liable. Ive talked with a lawyer about this in Florida. That may be enough to get the lender to approve it.

The cosigner cosigns for the car buyer so they can pay for the car and establish credit. He can be liable up to the amounts specified in Mr. The problem with co-signing on a loan is that if the primary borrower begins missing payments the liability will fall on you.

Your dads insurance might also cover you because you were a permissive user of his vehicle. You are essentially borrowing the good credit of your cosigner in order to make your application more appealing to lenders. You can cosign an auto loan for a family member or close friend.

It is your responsibility to ensure that the car is properly insured and continually covered. Regardless as a cosigner liability does extend to you including if the person loans the car to a friend and they do something negligent. As mentioned cosigning an auto loan does not make you liable for what the primary borrower does with the car.

Laws on co-signers vary from state to state but the general rule is a co-signer is equally liable for payment in full and just as qualified to become a defendant in a lawsuit. Freeman says you could ask for an extra set of keys to the car youve helped someone buy and agree that if payments are not made on time you have. You get all the benefits of car ownership including the reporting of monthly payment activity to the national credit bureaus.

September 11 2017 admin_en Comments 0 Comment. When you cosign a loan you assume one specific responsibility. Co-maker or guarantor.

Before you agree to cosign on a loan do your research to find out who will be liable if the borrower defaults on any payments. Whenever you consider funding or even rent a sizable product just like a brand new vehicle or even vessel a person accept help to make normal obligations before. You by cosigning commit your good credit to the loan.

Since you did not have your own insurance your dad needs to contact his insurance company and notify them of the claim. Can I exclude debts that I co-signed contingent liability. In most cases the responsibility to pay the loan will be on your shoulders.

Repossession Credit score Guidance through Experian Repossession Credit score Guidance through Experian. Nov 26 18 at 2006. Often times as a cosigner one is placed on the title and often as primary.

Cosigner for a car loan liabilities formula. You may use the account but another person is responsible for the debt. This puts a somewhat awkward twist on what might be an otherwise excellent relationship.

An individual who needs a car loan but who doesnt qualify because of a low credit score may get the loan with the help of a co-signer with a better credit history. Your dad can be sued because he is a registered owner of the vehicle but not because he co-signed your loan. This answer is categorically incorrect.

Opting for a cosigned car loan can make your loan less expensive even if you have a bad credit score. LIABILITY AFTER A CRASH. You will not be held responsible for any accidents resulting from the drivers negligent acts.

Before signing anything there are a couple things to consider. While a cosigner can help you get an auto loan theyre taking on risk. The money received by the car buyer is used to pays back the cash paid for the car makes a promise to pay for the car loan and keep it insured.

You have contractual responsibility to pay the debts on the joint account. A cosigner on an auto loan agrees to take full legal responsibility for repaying the loan if you cant pay it back. When you cosign a car you have vicarious liability that is you are responsible to an extent for any damages that may be caused by the actions of the driver.

If a cosigner on loan only and not named on the title you are fine with liability but know you are on the hook if the loan is not paid and also can play in to your credit rating. This question is incredibly common especially for parents who have been a co-signer for one of their children either for a car loan or a student loan. Having a cosigner for a car gives a lender extra assurances that the loan will be repaid.

Suppose for example that your siblings credit is too poor to land an auto loan. At this point the it is the understanding of the cosigner. A co-signer guarantees repayment of a loan if the principle borrower defaults.

Avoid Using a Cosigner for a First Time Car Loan. The cosigner is agreeing to be held accountable financially and legally for the repercussions that would occur if you defaulted on the loan or even missed a payment. However you are liable.

Once this part of the deal was done the cosigner finds out the person lied and the only way to get their money back is by cosigning for the car loan.

How To Get Your Name Off A Joint Car Loan 500belowcars Com

Get Pre Approved For Auto Loan Car Loans Loan Car Finance

What Happens To Your Car Loan When Your Cosigner Is Deceased

How To Remove A Cosigner From A Car Loan Allen Samuels Cdjr Aransas Pass

If I Cosign For A Car Loan Do I Have To Be On The Insurance

Does Cosigning A Loan To A Car Make You Responsible If The Person Gets In An Accident Gets Sued

Students Can Also Avail Guaranteed Approval Car Loan Or Student Auto Loans Without Cosigner By Approaching The Right Lenders And Student Data Edutopia Teaching

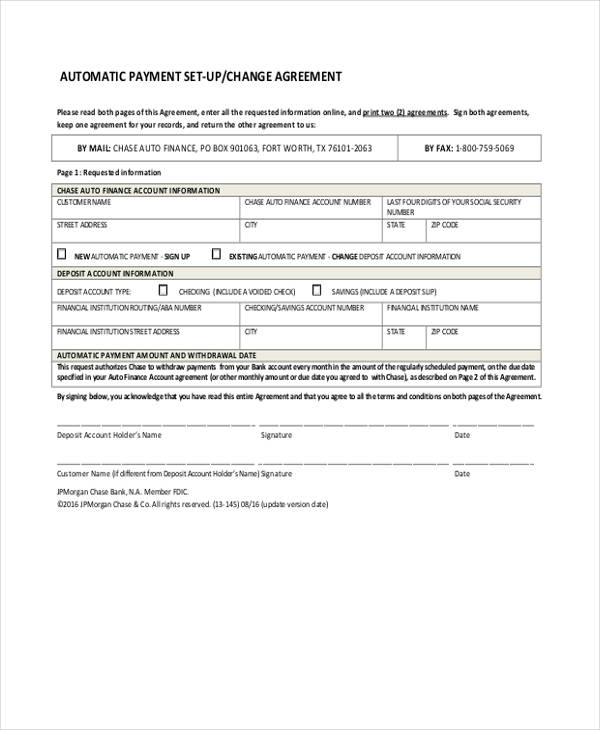

How To Make A Car Loan Agreement Form Samples 5 Samples

Nen Hay Khong Nen Vay Mua Xe O To Tr Gop Donate Car Car Insurance Cars Organization

How To Make A Car Loan Agreement Form Templates Free Premium Templates

How Does Cibil Score Affect Your Car Loan Cibil Blog

How To Get A Car Loan Without A Cosigner In Canada

What Does It Mean To Have A Joint Auto Loan

Free Car Loan Application Form Car Loans Loans For Bad Credit Loan

What S A Good Apr For A Car Loan Find Out Now Br Telco Federal Credit Union

3 Things You Should Consider Before Co Signing For An Auto Loan Consumer Financial Protection Bureau

How To Remove A Cosigner From A Car Loan Allen Samuels Cdjr Aransas Pass

What You Need To Know About Co Signing A Car Loan U S News World Report

Free Car Loan Application Form Car Loans Car Finance Bad Credit Score

Post a Comment for "Cosigner For A Car Loan Liabilities"